| can't see the pictures? view it in your browser here. | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

Here’s a CO2 injection pilot that had injectant break-through within a few months of the start of injection. Even more heartbreaking: No extra oil rate was observed. CO2 injection was abandoned within a month of the gas shock front. That’s why they call it a shock front. The large amount of gas break-through came as a great shock to this operator. What was the problem? The operator forgot to consider the natural fracture trend of the reservoir. The injector was directly connected to the producer through natural fractures. The natural fractures were “enhanced” by propped hydraulic fracturing. They created a pipeline from injector to producer. The fracturing process will open up natural joints and fractures in the matrix creating a short cut path for gas. In such circumstances, a poorly placed horizontal producer can gas out very quickly after the start of injection.

Once an operator understands the preferential fracture direction, many great enhanced oil strategies can be used to double, triple and even quadruple recovery factors using horizontal multi-fractured wells. Call Proven’s enhanced recovery experts for examples of horizontal multi-fratured successes and failures. We can help you improve your chances for a great “after-life” for your pool. ~Granger J. Low |

|

|

|

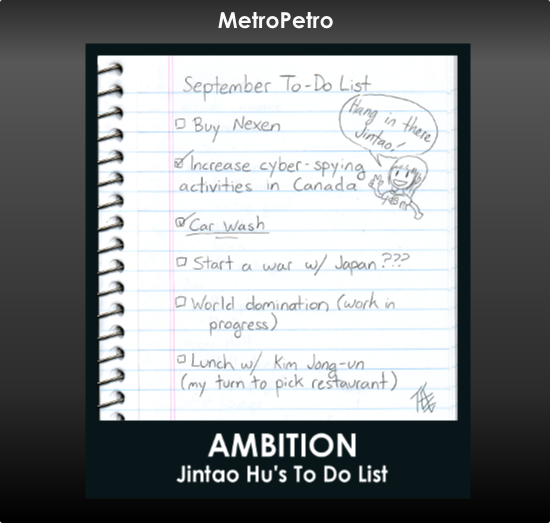

The China National Offshore Oil Corporation (abbreviated as CNOOC) has recently tabled a friendly take-over bid of Nexen Inc. to the tune of $15.1-billion, attracting the gaze of not only Government of Canada, but also the average citizen. Offering $27.50 per Nexen share (approximately 60% higher than its closing share price), the takeover deal is deemed to be the largest attempted by China to date.

However, some politicians and citizens alike have wondered what exactly a 'net benefit for Canada' means. According to Industry Canada's official website, examining a deal in terms of 'net benefit for Canada' includes: a) the effect on the level of economic activity in Canada, on employment; on resource processing; on the utilization of parts and services produced in Canada and on exports from Canada; b) the degree and significance of participation by Canadians in the Canadian business or new Canadian business and in any industry or industries in Canada; c) the effect of the investment on productivity, industrial efficiency, technological development, product innovation and product variety in Canada; d) the effect of the investment on competition within any industry in Canada; e) the compatibility of the investment with national industrial, economic and cultural policies; and f) the contribution of the investment to Canada's ability to compete in world markets. The investor is asked to provide data and documentation demonstrating the above as fully as possible. Industry Canada also notes that none of the above requirements are necessarily weighted more or less than any other, and that the positives must ultimately outweigh the negatives. While speculations as to whether or not CNOOC will be able to prove the above satisfactorily remain anyone's guess, the government has promised that the decision will bring with it a clearer framework for future proposed national corporation takeovers. |

Brandon Low has worked in various capacities at Proven Reserves since 2000 and is currently the communications editor and administration manager. Brandon was born and raised in Calgary, but has also lived abroad in Japan and the USA for several years. Brandon studied Japanese and Communications at Brigham Young University, and though he works in communications, he enjoys keeping up with his Japanese as well. He has worked on Proven’s newsletter and marketing efforts since 2003. In his spare time, Brandon enjoys spending time with his family, visiting new places, and creating and appreciating art in many forms. He also enjoys video gaming when he has the time. Brandon’s favourite holiday is Christmas, and least favourite holiday is his birthday. Brandon says his goals are to help increase Proven Reserves’ value for our clients, and help build bridges in the industry. He also hopes to one day become a waterpark connoisseur. Thanks me! |

|

|

|

When you inject gas into a reservoir with horizontal multifractured wells you could be in for a big shock.

When you inject gas into a reservoir with horizontal multifractured wells you could be in for a big shock.  One big mistake operators may regret for a long time: Assume that every formation is homogeneous and fracture direction doesn’t matter.

One big mistake operators may regret for a long time: Assume that every formation is homogeneous and fracture direction doesn’t matter.

But while the deal is a no-brainer for Nexen investors, the takeover of a major Canadian oil player by the national oil company of the largest remaining communist nation raises some uncomfortable questions. One of which the government will forced to answer before the deal goes through is 'will the deal provide a net benefit for Canada?'

But while the deal is a no-brainer for Nexen investors, the takeover of a major Canadian oil player by the national oil company of the largest remaining communist nation raises some uncomfortable questions. One of which the government will forced to answer before the deal goes through is 'will the deal provide a net benefit for Canada?'